The Opportunity

In the dynamic realm of financial technology, adherence to regulatory standards is paramount. The financial institution at the heart of this case study, an emerging entity in the Indian financial sector, faced the challenge of aligning its AWS infrastructure with the stringent guidelines set by the Reserve Bank of India (RBI).

The RBI mandates rigorous controls and policies to safeguard financial data and ensure the integrity and resilience of financial institutions. These encompass data encryption, access controls, audit logging, incident reporting, and disaster recovery, among others. RBI’s Guidelines on Cybersecurity Framework specifically outline best practices to help financial institutions improve their cybersecurity posture and meet regulatory compliance requirements.

This particular finance organization partnered with SourceFuse, working in collaboration with AWS, to orchestrate a transformative journey enabling it to achieve and maintain RBI compliance seamlessly.

Key Challenges

To comply with RBI’s security requirements, the customer faced various challenges, including:

- Complexity:

Managing a multitude of AWS services and configurations was complex and error-prone. - Change Management:

Ensuring that security controls and policies are consistently applied as the environment evolves. - Visibility:

Maintaining real-time visibility into security status and potential risks. - Scalability:

Adapting security measures to accommodate growing workloads and expanding services. - Audit and Compliance:

Meeting regulatory requirements and facilitating audits efficiently.

The Solution

In order to navigate the rigorous landscape of regulatory compliance set by the Reserve Bank of India (RBI), the company enlisted SourceFuse to enhance its cybersecurity framework.

SourceFuse implemented a comprehensive suite of AWS services and best practices to fortify the bank’s cloud infrastructure. This included:

- Leveraging AWS Systems Manager for detailed insights, patch management and automations.

- Centralized account management, Consolidated Billing, Service Control Policies through AWS Organizations.

- Ensuring data integrity with Amazon Elastic Container Repository (ECR) Tag Immutability.

- Bolstering network security by issuing X509 certificates through AWS Certificate Manager.

- Encryption measures implemented both in transit and at rest across various AWS services.

- Controlling access by securing resources within Amazon Virtual Private Cloud (VPC), while AWS Web App Firewall (WAF) provided robust protection for web applications.

SourceFuse’s meticulous approach extended to vulnerability management with Amazon Inspector, AWS Identity Access Manager (IAM) implementation based on least privilege principles, and comprehensive logging and monitoring using AWS CloudWatch, Amazon CloudTrail, and VPC flow logs.

This strategic collaboration transformed the finance organization into a cybersecurity stronghold, showcasing the effectiveness of a holistic approach to regulatory compliance and data protection.

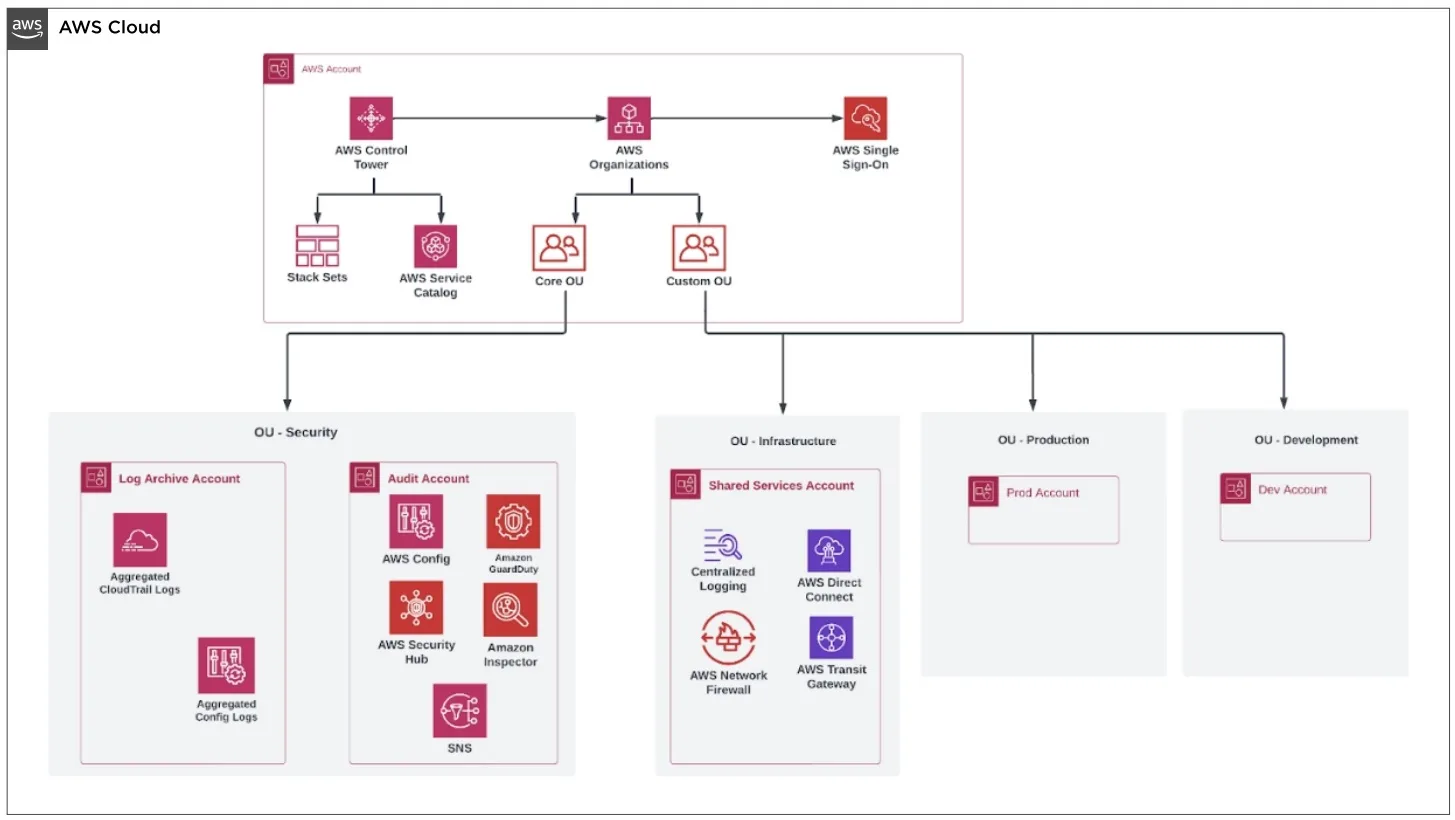

Harnessing the AWS Landing Zone Architecture

SourceFuse fortified the security and compliance of the customer’s AWS infrastructure through the strategic implementation of the AWS Landing Zone Architecture. This sophisticated solution, grounded in AWS best practices, enabled the bank to establish a meticulously organized, multi-account environment in alignment with industry standards and regulatory requirements, particularly those set by the RBI. The Landing Zone not only expedited the creation and management of AWS accounts but also ensured a consistent and scalable approach to security, adhering to the principle of least privilege.

The AWS Landing Zone Architecture played a pivotal role by automating the provisioning of new accounts with pre-configured security policies, enforcing a stringent security baseline encompassing network configurations and identity and access management policies.

Moreover, the Landing Zone facilitated seamless logging and monitoring through the automated setup of CloudTrail and CloudWatch, crucial for continuous auditing and real-time identification of non-compliant activities.

The Results

In conclusion, leveraging the AWS Landing Zone architecture offered the finance organization a powerful, automated solution to achieve and maintain RBI’s security compliance requirements. By embracing this architecture, the bank was able to establish a secure, well-structured, and compliant AWS environment, ensuring the confidentiality, integrity, and availability of their critical financial data and systems.

By automating compliance processes, ensuring consistent security policies, and implementing continuous monitoring, the bank is now able to focus on their core business activities with the confidence that its AWS infrastructure aligns with RBI regulations and industry best practices, thereby enhancing trust among customers and stakeholders.

About The Customer

Founded in 2021 and headquartered in India, the finance institution aspires to be India's first truly digital bank. Leveraging the best-in-class technology, it aims to ensure access and ease of banking for all – including the underserved.