For organizations that process invoices, a quick and efficient turnaround is the cornerstone of maintaining the business cash flow. When you consider that paper-based and email methods are still used to capture, register, share, approve, chase and archive payments, it is understandable that without the ability to automate invoice processing, occasional invoice errors will occur. However, the impact of being paid late, or not being paid at all, can seriously undermine customer relationships and employee motivation, while monthly income is not guaranteed.

Common invoice processing challenges include:

- Clarity – where invoice information can be interpreted incorrectly, such as due date, or details of products or services provided

- Accuracy – such as an incorrect charge, missing customer details, or simply a misplaced decimal point

- Main contact – where the main customer point of contact is not clear, notifications are missed in email trails, and inefficient processes are slow to react to alerts.

Using software, and leveraging cloud services, to automate invoicing processing seems the obvious solution, but handling invoices from different customers on a single platform is not as easy as it sounds. A wide variety of invoice designs and layouts, and the quantity and quality of information, makes it a real challenge when it comes to automatically extracting and collating information.

Invoice Processing Challenges in Reality

In recent conversations with a global digital media agency, we learnt about the ongoing challenges faced with invoice processing, despite already using a custom-built invoice management platform, which implemented cloud technology. For Broadcast channels (TV, Radio, Cable), where invoicing is a very similar process between organizations, the agency’s clients were able to upload standard format invoice files, with the extension .txt, .dat or .NCC, to the invoicing platform. Once these files were uploaded, the information contained could then be automatically analyzed and successfully loaded directly to a database. And because of the similar invoicing formats, it was very straightforward to see what adverts had been placed, the invoices raised, and any outstanding payments.

However, when it came to the agency handling invoices for non-broadcast channels, i.e. online advertising or digital marketing, each of their clients had its own invoicing method, primarily sending or emailing PDFs in a bespoke company design. Therefore, it was difficult to use the same level of invoice automation for non-broadcast channels, to import, extract, compile and reconcile historic information, such as the invoice date, amount, company name, and what the invoice was for. In this case, the agency had to resort to manually generating and updating a spreadsheet to capture the information from hundreds of different vendors, a process open to inefficiency and inaccuracies.

Taking Invoice Processing to the Next Level

Building on its existing automated invoice management platform for broadcast channels, the media agency was determined to deploy invoice automation and additional cloud technology for non-broadcast channels too. The key to reducing manual invoice processing was to implement a unique combination of cloud services to automate data extraction:

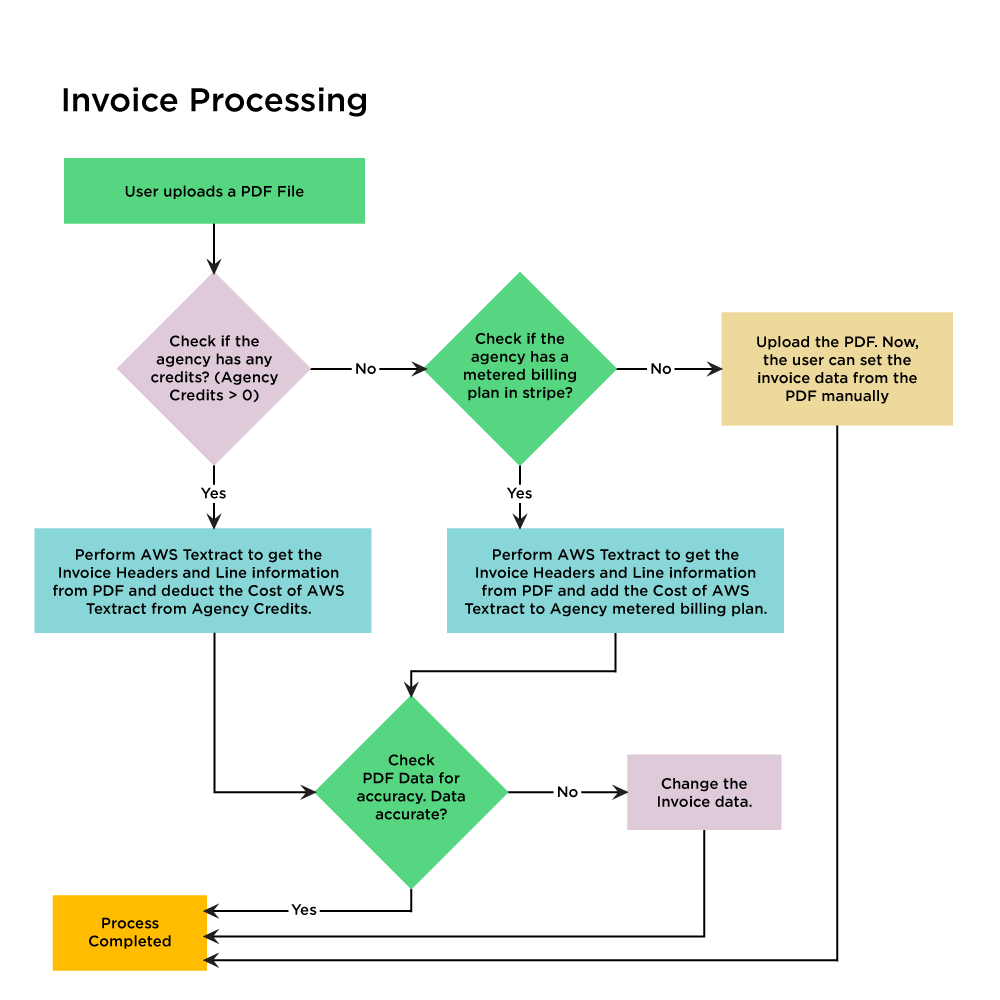

- Amazon SQS and AWS Lambda: after uploading a PDF file, the simple queue service (SQS) triggers the Lambda function to automatically trigger the data extraction.

- Amazon Textract: a machine learning service that uses optical character recognition to automatically extract text from PDFs. In this case, Amazon Textract is used to extract headers and line information from the uploaded invoice PDF and store the data in the application database.

- AWS S3: designed for storing and protecting any amount of data, providing scalability and security for a range of enterprise applications.

- PubNub: a live sync feature to show the data extracted by Amazon Textract from the PDF in the invoice panel.

- Dynamsoft Dynamic Web TWAIN: API integration for browser-based document scanning designed specifically for web applications. Once scanned, this service automatically triggers the Amazon Textract procedure.

Implementing these additional cloud services, the new automation solution workflow is now as follows:

Non-Broadcast Channel Invoice Automation: The Results

Even when you think your digital transformation journey is complete, there are always new features and services emerging that can further optimize business processes. In the example shared above, this agency was able to take its existing and successful invoice management platform and incorporate additional functionality to expand its customer base and significantly improve efficiencies and productivity. It is now able to:

- Track and monitor clients’ usage of the platform, using Amazon Textract as a pay-as-you-go service. Clients with billing plans have the Stripe product details automatically added for metered billing.

- Offer clients the ability to review the invoices for accuracy, and adjust header fields if necessary.

- Provide clients with the flexibility to manually enter data, in the case where a client has no agency credits or billing plan.

- Add credits based on the client’s subscription. Each time the client uploads an invoice PDF, credits will be automatically deducted. When no credits remain, further PDF uploads will trigger the platform to automatically add the cost to the client billing plan.

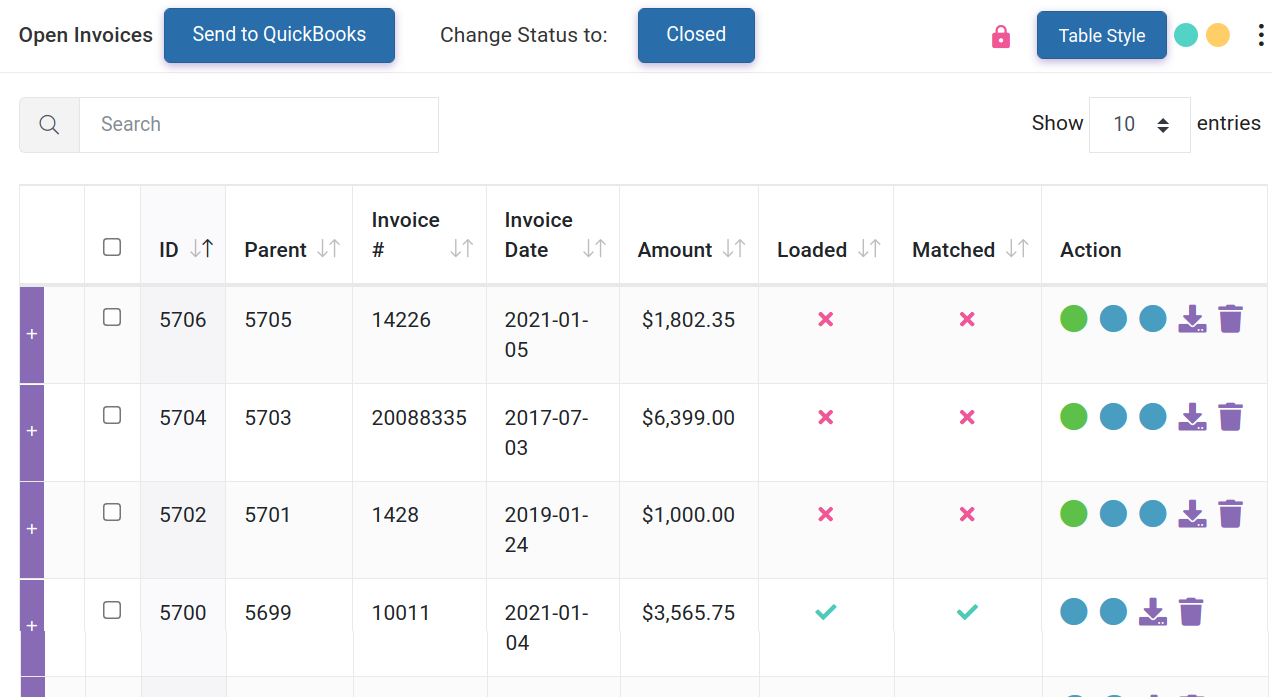

- Deliver an intuitive user interface for an enhanced customer experience, with simple drag and drop file uploading, and dashboards highlighting any discrepancies: